In an attempt to modernize and enhance the efficiency of financial transactions, the Mauritius Revenue Authority (MRA) has introduced a national e-invoicing system. This transformative initiative is set to revolutionize how economic operators issue invoices and receipts, bringing with it a host of benefits such as a level playing field, transparency, and improved tax compliance.

This blog aims to guide businesses through the process of generating e-invoices as per MRA guidelines.

Phase 1: EBS Software Developers and Solution Providers

Commencing in June 2023, Phase 1 focused on EBS software developers and solution providers who played a vital role in this journey. Their responsibilities included system registration, customization, testing, and self-certification to ensure compliance with the MRA's e-invoicing system. This phase primarily targeted developers working for EBS manufacturers, solution providers, and in-house ICT departments of public and private organizations utilizing EBS.

Phase 2: Economic Operators Prepare for Compliance

The transition from Phase 1 to Phase 2, expected to begin in Q1 2024, shifts the spotlight to economic operators, especially those with an annual turnover exceeding Rs 100 million (EUR 2.1 million). This phase will later extend to include a broader taxpayer base.

During Phase 2, economic operators must integrate compliant EBS systems into their operations after verification by software developers or solution providers. Compliance testing, as prescribed by the MRA, is a mandatory step before full participation in the e-invoicing system.

Generating E-Invoices: Webtel’s Offering

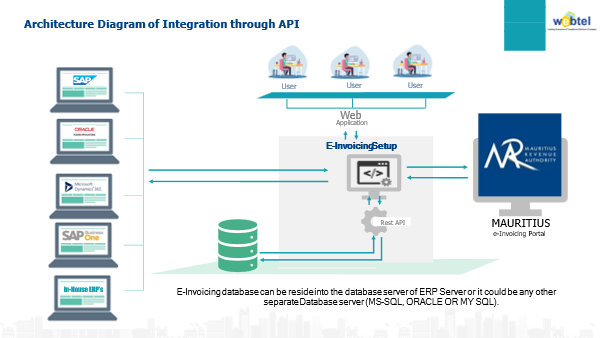

To assist taxpayers in this transition, Webtel offers an e-Invoicing Solution with both On-Premise (Local Host) and Cloud-Based (SaaS Model) options. The key components of Webtel's solution include:

1. E-Invoicing Application: The core application for generating e-invoices in compliance with MRA guidelines.

2. Connector/Integration with Accounting ERP: Seamless integration with accounting ERP systems for efficient data retrieval.

3. Connector/Integration with MRA: Integration with the MRA e-Invoicing system to ensure real-time fiscalization.

4. Upload Data: Utilizing APIs, Webtel fetches e-invoice data from the client's ERP system.

5. Response Back to Database: The obtained IRN and QR code from MRA is provided to the client's ERP for printing on invoices.

Conclusion:

As Mauritius embraces the digital transformation in invoicing, it is essential for businesses to adapt to the changing landscape. Following the outlined phases and leveraging solutions like Webtel's e-invoicing software can help economic operators streamline their invoicing processes, ensuring compliance with MRA guidelines. Embracing e-invoicing not only enhances business efficiency but also contributes to the broader goals of transparency and improved tax compliance set by the MRA.