In the ever-evolving landscape of digital transformation, Malaysia is taking significant strides toward modernizing its tax systems and facilitating seamless business transactions. One such initiative is the implementation of e-Invoices by the Inland Revenue Board of Malaysia (IRBM).

This blog aims to provide a comprehensive guide on generating e-Invoices in Malaysia, emphasizing the available options, implementation timeline, and the solution offered by Webtel.

Understanding e-Invoice:

An e-Invoice serves as a digital counterpart to traditional paper or electronic invoices, encompassing crucial transaction details between suppliers and buyers. It contains essential information such as supplier and buyer details, item descriptions, quantities, prices excluding and including taxes, and the total amount.

The shift to e-Invoices eliminates the need for physical documentation, streamlining business operations and reducing environmental impact.

e-Invoice Transmission Mechanisms:

To facilitate the transition to e-Invoice, taxpayers in Malaysia have two options for transmitting their invoices to the IRBM:

1. MyInvois Portal: Hosted by the IRBM, this portal is accessible to all taxpayers at no cost.

Suitable for those who need to issue e-invoices when an Application Programming Interface (API) connection is unavailable.

2. Application Programming Interface (API): An API facilitates direct data transmission between taxpayers' systems and the MyInvois system.

Requires an upfront investment in technology and adjustments to existing systems. Ideal for large taxpayers or businesses with substantial transaction volumes.

e-Invoice Implementation Timeline:

The implementation of e-Invoices in Malaysia is phased to ensure a smooth transition for taxpayers. The timeline is as follows:

• 1 August 2024: Taxpayers with an annual turnover or revenue of more than RM100 million.

• 1 January 2025: Taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million.

• 1 July 2025: All taxpayers.

Webtel's e-Invoicing Solution:

Webtel offers a comprehensive e-Invoicing solution for businesses in Malaysia, providing both On-Premise and Cloud-Based options.

1. On-Premise Solution - Local Host:

Suitable for businesses preferring to host the e-invoicing solution locally. Ensures control over data and infrastructure.

2. Cloud-Based Solution - SaaS Model:

Ideal for businesses seeking a scalable and flexible solution without the need for extensive infrastructure. Offers accessibility and convenience.

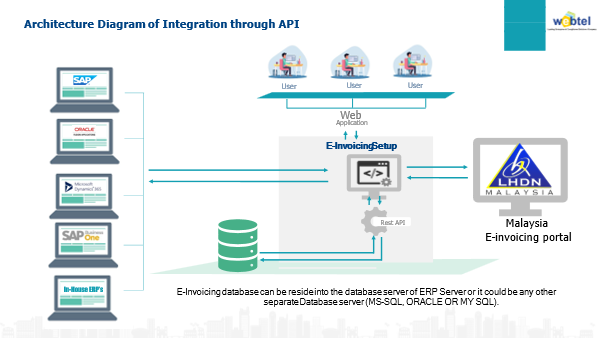

Webtel's Role and Methodology:

• Technology Integration: Webtel employs state-of-the-art technology for seamless e-Invoice integration.

• Data Upload Using APIs: Utilizing APIs, Webtel fetches e-Invoice data from the client's ERP system.

• Upload on Web Solution and IRBM: The e-Invoice data is uploaded to both Web Solution and the IRBM, ensuring regulatory compliance.

• Response Back to Database: QR codes obtained from the IRBM are provided to the client's ERP for printing on invoices.

Conclusion:

As Malaysia embraces the era of e-Invoicing, businesses are presented with a golden opportunity to enhance efficiency, reduce costs, and contribute to a more sustainable future. With careful planning and the right technology solutions, the transition to e-Invoices promises a seamless and productive experience for taxpayers across the country.

Webtel's offerings stand as a testament to the commitment to facilitating this digital transformation in the Malaysian business landscape.