What is the Applicability for VAT Registration?

ZATCA mandated VAT registration for individuals and businesses fulfilling the following criteria,

- The taxpayer is a resident of KSA.

- The total value of taxable supplies exceeded SAR 375,000 in the previous 12 months or is expected to exceed SAR 375,000 in the coming 12 months.

What are the Exemptions for VAT Registration?

As per ZATCA guidelines, VAT registration is exempted for taxpayers who exclusively make zero-rated supplies despite meeting the applicability requirements for the mandatory registration threshold limit.

What is the process to Verify VAT Registration in KSA?

Here’s the step-by-step process to verify the VAT registration number in Saudi Arabia.

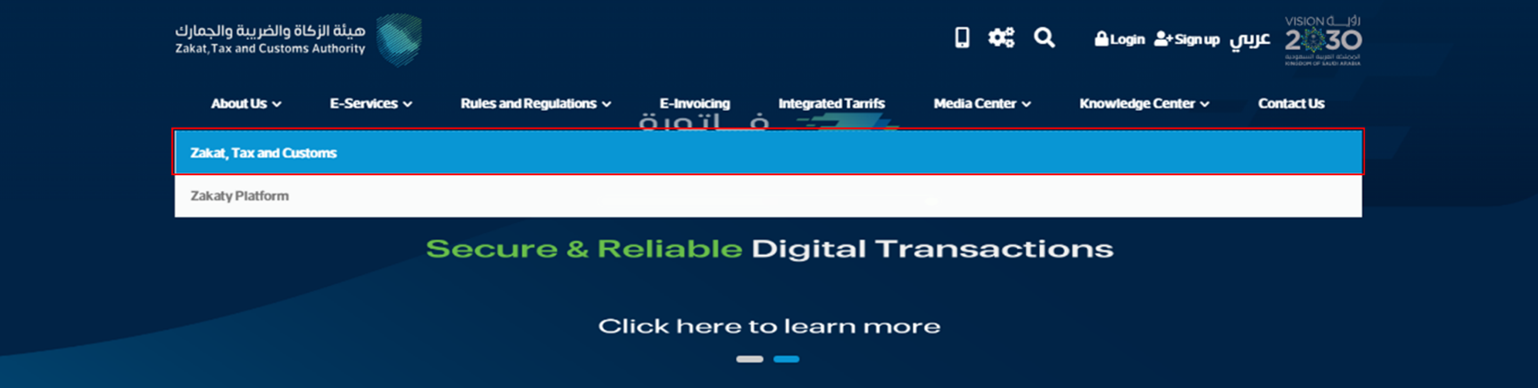

Step 1: Visit zatca.gov.sa and select the “E-Services” option from the main menu.

Step 2: From the dropdown, select the “Zakat, Tax and Customs” option.

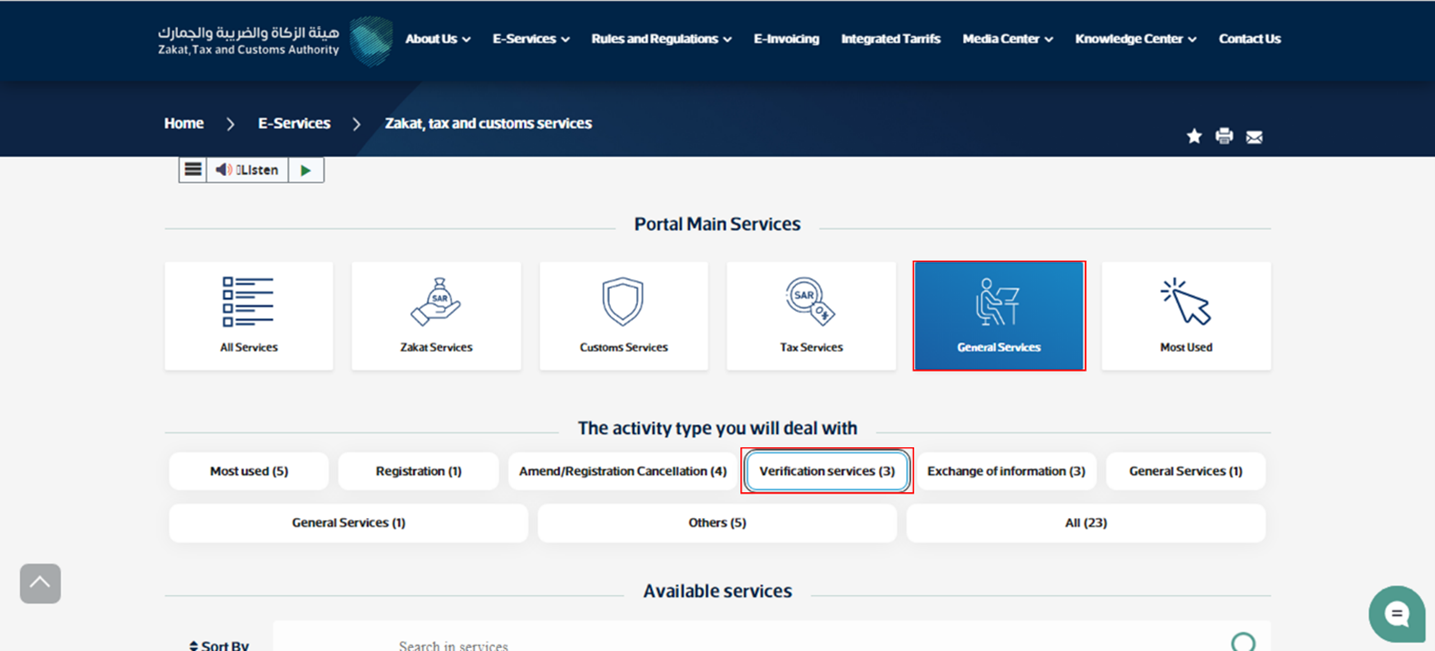

Step 3: Now click on “General Services” and select the “Verification Services” option.

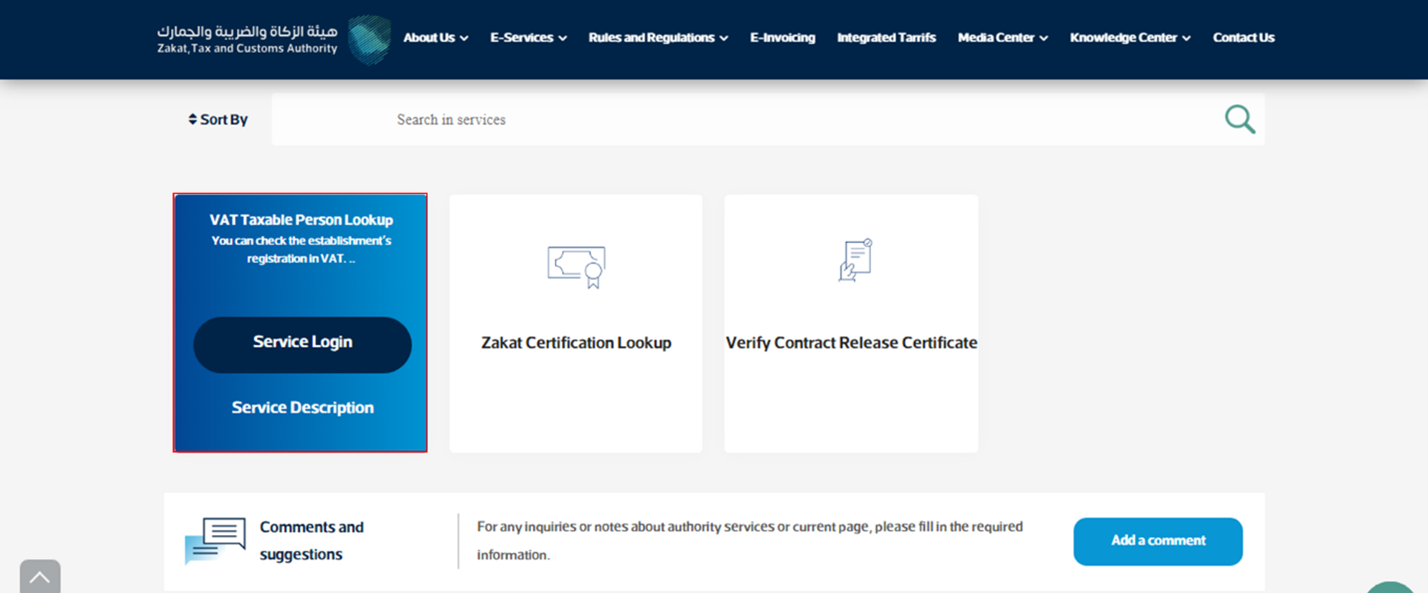

Step 4: Now select the ‘VAT Taxable Person Lookup’ and click on ‘Service Login’.

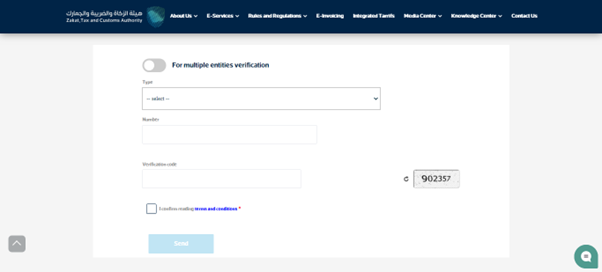

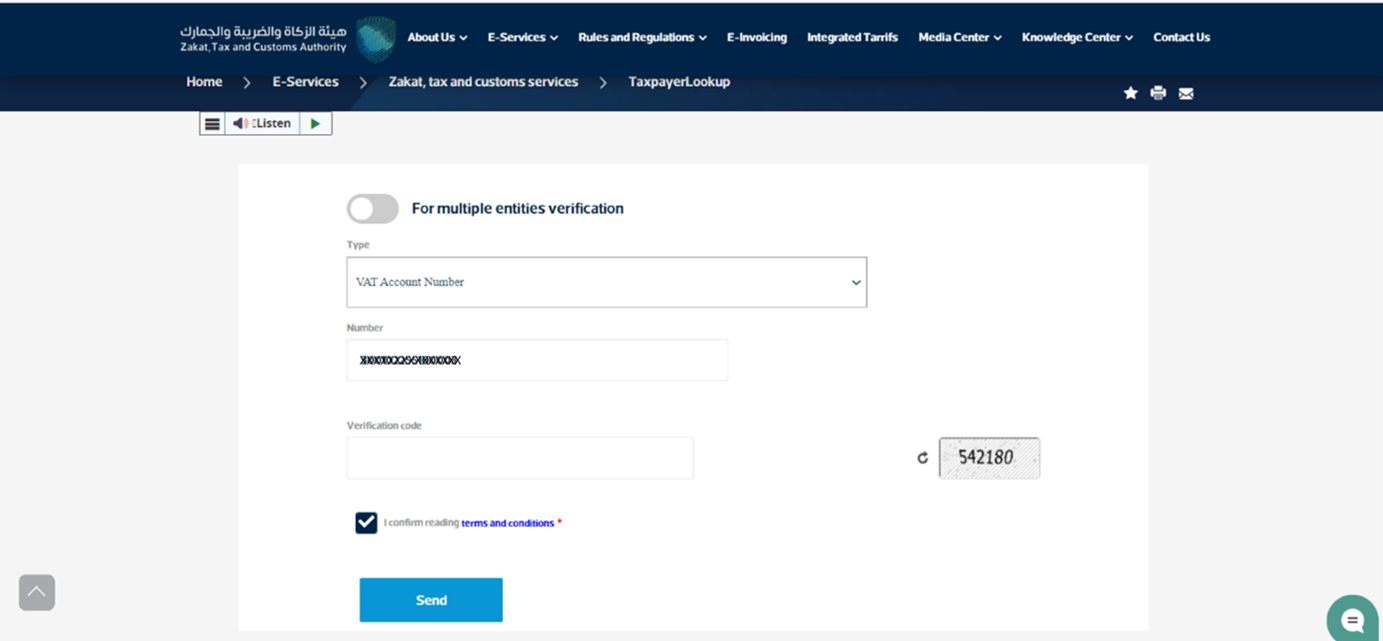

Step 5: You will be redirected to the given window.

Step 6: Now you can furnish the VAT Number and other required details, along with the verification code. Once the input has been added, click on send.

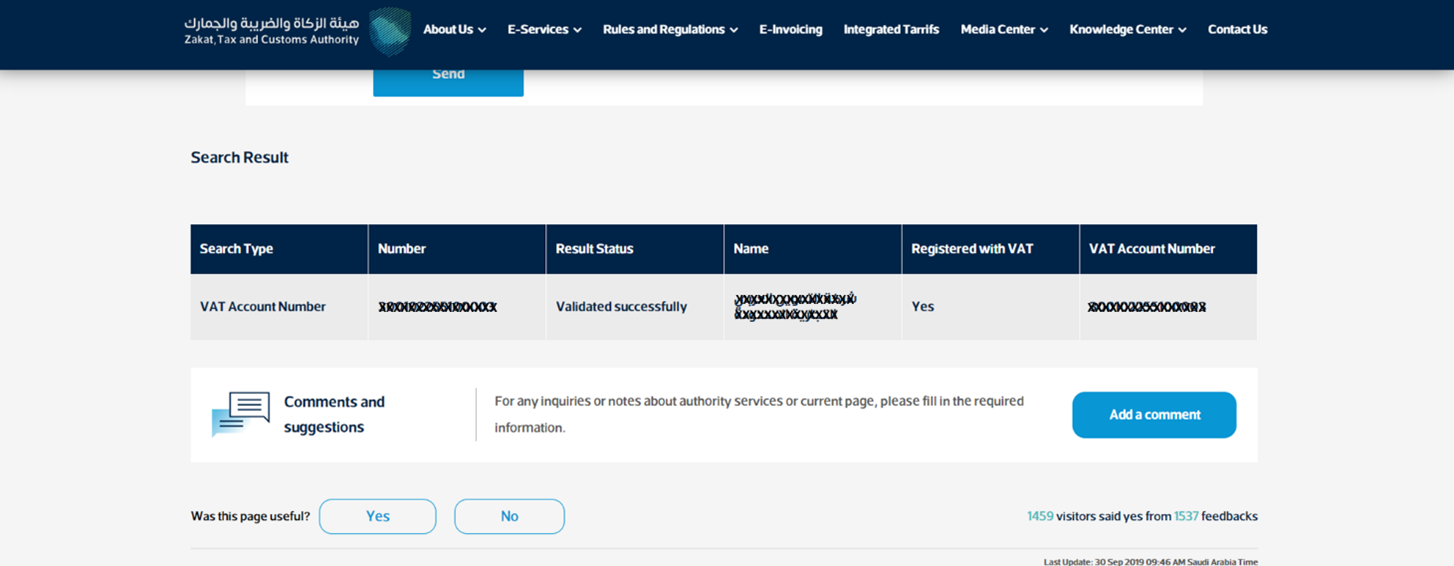

Step 7: The below search results will appear,

Search Type

Number

Result status

Name

VAT Registration status

VAT Account Number

By verifying VAT Registration, you can check the authenticity of the VAT Number and prevent any possible VAT fraud.