Salary and payroll calculation is an important aspect of the routine activities of HR Management. The salary structure in India comprises various components like CTC, gross salary, net salary, allowances, deductions, etc.

The salary structure in India defines a framework for employee remunerations and understanding this structure is important for the accurate and timely calculation of payroll.

In this blog, we will discuss what is the salary structure in India and what are the various elements of salary calculation.

What is the Salary Structure in India?

Salary structure in India is defined by the elements and framework laid down for companies and management for payroll calculation and rendering remuneration to the employees every month. The salary structure has various components and elements that have been discussed further in this blog.

What is a Salary Structure and what are the elements of salary?

The salary structure is determined by the components, as decided by the companies or their management, that are paid out every month. A salary structure aims to lay out the anatomy of the salary being offered in terms of the different components constituting the compensation plan.

What is CTC and how is it calculated?

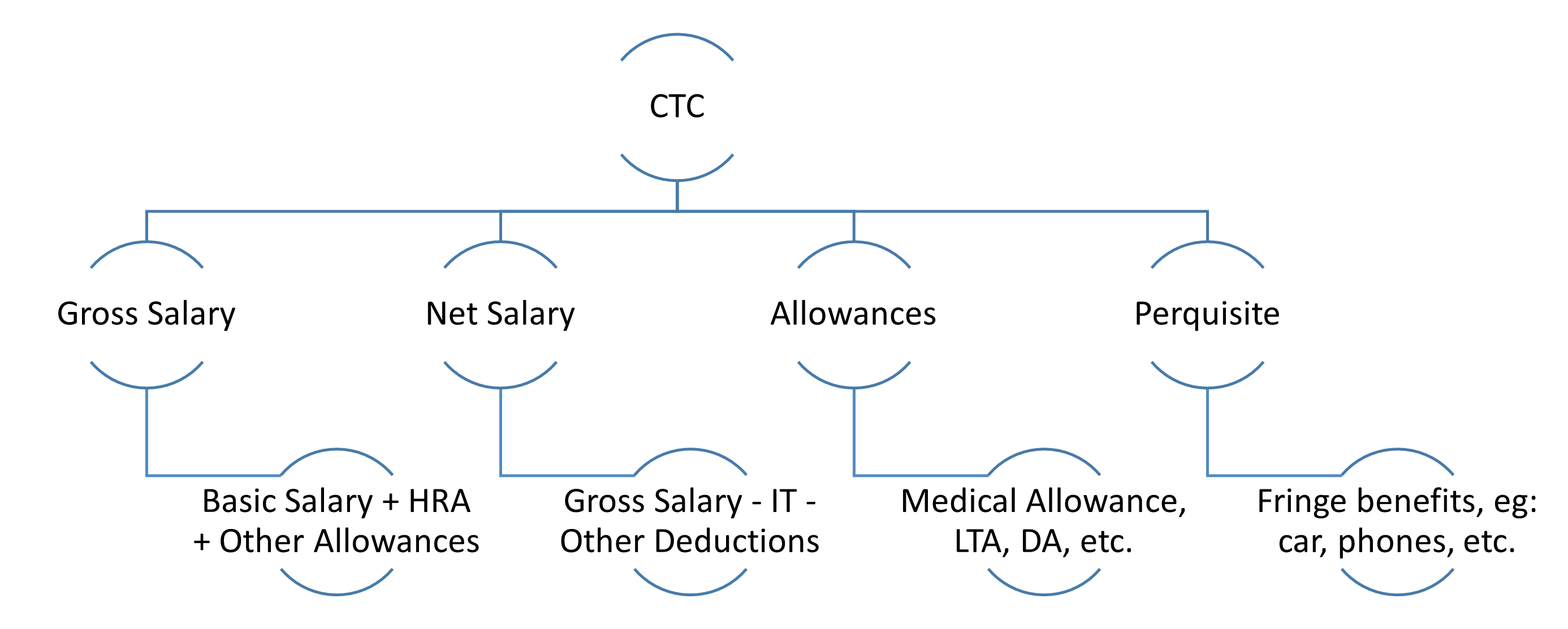

CTC or Cost to Company is the annual expenditure incurred by the organization on the services rendered by the employees, based on salary and other variables. CTC includes Basic Salary and additional benefits offered by the company, such as gratuity, EPF, HRA, Travel Allowance, etc.

CTC = Gross Salary + Benefits

Basic Salary

The basic salary is the base income of the employee, that is the fixed cost offered by the organization, prior to any reductions, additions, and allowances. The basic salary comprises around 50% of the CTC and is fully taxable.

- House Rent Allowance

HRA or House Rent Allowance is paid to employees living in rented accommodations for meeting the monthly rental expenditure for housing. The amount of HRA cannot exceed 50% of the basic salary in metro cities and 40% of the basic salary in non-metro cities.

Salaried individuals residing in rented housing/accommodations can claim tax exemption and fully or partially reduce their tax liability. For employees who don’t live in rented accommodations, HRA is fully taxable.

Gross Salary

Gross salary is the amount calculated by adding allowances, such as bonuses, overtime, and so on to the basic salary of the employee before making the necessary deductions and tax payments.

Gross salary = Basic salary + HRA + Other Allowances

Net Salary

Net salary is the amount calculated after making TDS (Tax deducted at Source) deductions and other deductions to the gross salary of the employee.

Net salary = Gross Salary – Professional Tax – Employee Provident Fund – Income Tax

Allowances

Allowance is the fixed amount paid by the company to meet certain expenditures incurred by the employees above the basic salary, and are added to the basic salary to calculate gross salary when deriving the salary structure.

- Dearness Allowance

Dearness Allowance is the percentage of basic salary that is paid to the employees to reduce the burden of inflation on salaried employees. The government provides the amount (normally set at 5%) of DA (Dearness Allowance) to compensate public sector employees and pensioners for the overall price rise.

Note that Dearness Allowance is fully taxable.

- Leave Travel Allowance

Leave Travel Allowance (LTA) covers the travel expenses incurred by the employees for travel within the country. LTA is eligible to tax exemption, subject to certain restrictions,

- LTA covers only fare expenses.

- The mode of travel needs to be air, railway, or public transport.

- LTA is eligible for travel within India.

- LTA is applicable only to family members dependent on the employee.

- Conveyance Allowance

Conveyance Allowance or transport allowance is offered to employees to compensate for the travel expenses incurred in traveling to and from residence and workplace. Conveyance allowance has been removed from tax exemption post-introduction of Standard Deduction from April 2018.

- Medical Allowance

Medical Allowance is the fixed cost that a company offers regardless of whether the individual receives medical treatment and submits bills to demonstrate the expenditure or not. Medical allowance has also been removed from tax exemption from April 2018 because of the introduction of Standard Deduction.

- Child Education Allowance

Children’s education allowance is paid against the tuition fees of the children of employees. Child education allowance is tax exemptible.

- Special Allowance

Special allowance is the amount paid by the organization to employees for various reasons and to meet different purposes. Special allowance is fully taxable.

Perquisites

Perquisites or fringe benefits are the benefits (mostly non-monetary) provided by the organization based on an employee’s official position. These benefits include the provision of a car for personal use, rent-free accommodation, internet services, and so on.

Perquisites are taxable for the monetary value of the benefit availed by the employee in addition to the salary.

Bonus

Bonuses are the compensations offered to employees in addition to the basic salary. Bonuses are usually provided as a reward for achievement or to express gratitude for the services offered by the employee. A bonus is fully taxable for the year it was received.

The provisions of the Bonus Act 1965 deem companies liable to pay the bonus to employees with a salary below Rs. 21,000 per month.

Deductions

Payroll deductions are deducted or withheld from the employees in the form of taxes or voluntary deductions and are deducted from the gross salary to calculate the net salary or take-home pay.

- Provident Fund (PF)

Provident Fund is a benefit scheme for employees where the employer and employee make monthly contributions for long-term saving opportunities.

- Employees' State Insurance Corporation (ESIC)

Employee’s State Insurance Corporation (ESIC) is a self-governed and self-financed social security scheme under the Employees State Insurance Act 1948 where the amount is deducted for the coverage of medical leaves. ESIC applicability varies depending on the state in which the organization or establishment is based.

- Professional Tax

Professional Tax is a direct tax that applies to those individuals who earn income from employment, trading activities, or professions. The professional tax contribution rate varies from state to state.

- Labour Welfare Fund

Labor welfare fund provides monetary aid to those in need to provide facilities to improve their work conditions and provide social security, hence, removing their living standards. The Labour Welfare Fund Act was introduced by the government to provide social security to workers in 16 out of 37 states including union territories.

- National Pension Scheme (NPS)

National Pension Scheme is a voluntary deduction by employees, deducted from the bank accounts of the employees and invested by PFRDA-regulated fund managers as per the investment guidelines.

How to get rid of Complex Payroll Structures and Calculation Processes?

Payroll calculations and determining salary structure is a tedious task and inaccuracies in doing the same can lead to heavy penalties. But do not worry because we have a solution that can simplify your payroll calculation and salary structure determination.

HR Pearls by Webtel offer a Payroll Management System that facilitates fast and secure salary calculation. With smart and user-friendly features offered by Webtel’s best salary calculation software, you solve all your salary structure and calculation worries.

Want to know more about the best HR Management and Salary Calculation Software?

Visit: HR Pearls

Or call us at: +91 7303393220

Also Read,

What is HR Compliance Management System? | How to Choose Best HR CMS in 2023

Payroll Deductions in India | A Complete Guide to Payroll Deduction Calculations

Tips To Get Rid Of Wrong Payroll Deductions

The Ultimate Guide on Key Payroll Modules to boost your HR Management

HR Management Mistakes That Every HR Needs To Avoid